Good morning and Happy Friday!

Welcome to another edition of The Matt Viera Newsletter.

The newsletter with the goal to inspire you to live the life you actually want to live.

Thank you for your continued support.

If you enjoy reading this newsletter, please forward this email to someone you believe would enjoy reading this.

Writing a weekly newsletter is more challenging than I initially thought.

For example, last week, I published an article about "mini-retirements."

As I drafted last week’s newsletter, I believed it was my first time writing about mini-retirements.

However, as I was going through newsletter articles I previously published, I came across this: 3 Reasons Why You Should Take a “Mini-Retirement.”

Note to self: keep a running list of newsletter topics published.

Then, as I was trying to come up with a topic to write about this week, I came across a draft of a newsletter I wrote in 2022 and never published (yes, I double-checked).

The article was about one of my goals for 2023 (inspired in part by my friend Jose).

Without further adieu, here is (was) my 2023 New Year's Resolution:

I came to a realization last summer.

I can't tell you the exact genesis for this shift in mindset.

It was most likely a combination of several events:

The fact that the summer was coming to an end

I was finishing a 5-week mini-retirement in Spain

I no longer had to worry about federal student loans

Most (if not all) people would love an endless summer.

The freedom to live a life you actually want to live.

Take a moment and imagine the life you actually want to live.

Does it involve waking up early on weekdays to an alarm clock?

For 5 weeks last summer, I was doing (or rather not doing) just that.

There was a specific point during one of those sunny days in Spain in which I felt compelled to do two things:

Do whatever it takes to no longer trade my time for money

Write about it

Which begs the question: why didn't I have the realization sooner? Like decades ago?

Well, to answer that question, let's first review how we, as humans who live in the ultra-consumer-focused society that is the U.S., are programmed and conditioned to live:

College

Job/Career

Find a partner

Get married

Buy a house

Buy (lease) cars

Buy things to fill your house

Have children - teach the above

Work until you're 65 to pay off the above

Retire (maybe)

I'm reminded of a quote from Watchmen (one of Time's All-Time 100 Novels):

It's a joke. It's all a joke

Let me simplify the joke:

Work

Get paid

Buy things you don't need

Rinse and repeat ad nauseam

The punchline: before you know it, life has passed you by.

I admit: I was programmed and conditioned to live like this.

With hindsight being 20/20, what disgusts me is that I have to admit that the amount of money I spent in my life up until last summer can be described in one word: breathtaking.

What bothers me is that I never learned basic personal finance principles, or what I did learn, I never applied.

The counterargument is if I did learn basic personal finance principles decades ago, would I have applied them throughout my 20s, 30s, and 40s?

This a debatable question.

Either way, I have no one to blame but myself.

I have 4 college degrees and never took the time to learn and apply basic personal finance principles to my financial life.

And I am where I am.

Now, don't get me wrong, I've lived a pretty good life.

What's the point of this rant?

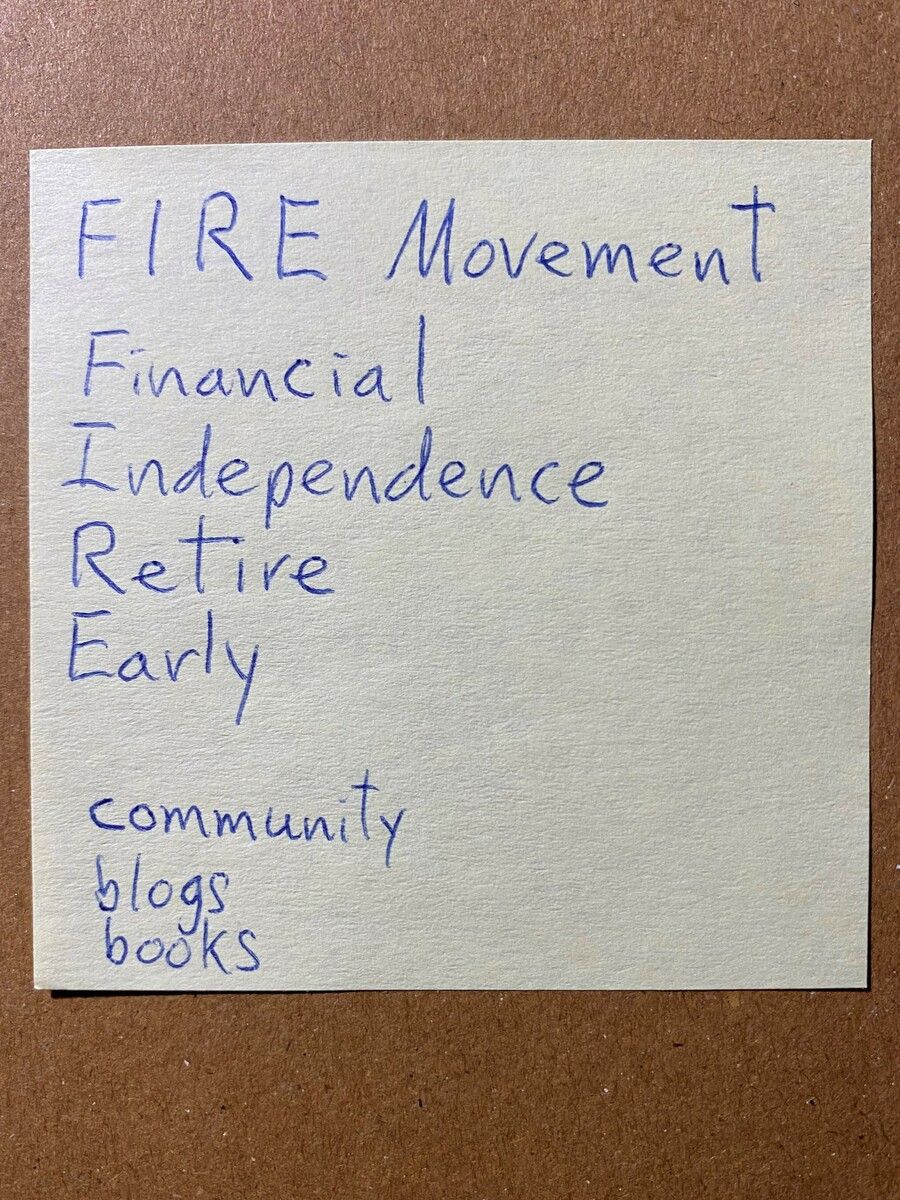

Before I get to that, the aforementioned realization seed was planted some years ago when, for some unknown reason, my friend Jose gave me the following sticky note after a meeting:

Jose is like the character Dom Cobb in the movie Inception - he planted an idea in my mind with this note.

I don't know why he gave it to me (thank you, Jose), and I have no idea why I kept it.

I did keep it; it's in my daily notebook.

So, the point of this rant:

Inspire you to live the life you actually want to live by effectively managing your personal finances.

My goal is to retire by 2028.

I'll be 56.

I wish I had realized this when I was 40 (or much younger).

Maybe if I did, I’d have the financial resources to no longer have to trade my time for money.

The truth is, I didn't have this realization.

It took me 4 or 5 years from the day Jose gave me that note to have the realization.

If you're younger than me (by a few decades), I implore you to develop a financial plan to retire (or stop trading your time for money) sooner rather than later.

If you're happy with your career and it's something you can do until you're 65+, that's cool.

Run with it.

However, if you can't see yourself doing what you're doing daily until you're 65+, take it from me, and come up with a financial plan to retire (or stop trading your time for money) sooner rather than later.

It won’t be easy.

It will requires some sacrifice.

But it is possible.

Figure out a way you no longer have to wake up to an alarm clock.

Then go and explore the world.

Life's entirely too short not to.

Interesting finds:

Thanks for reading!

Please feel free to reply to this email with suggestions, questions, or comments.

If you have a question about personal finance, send me an email and I’ll answer it in a future newsletter.

I read every email.

Check out my other articles here.

Follow me on Twitter.

If you are not a subscriber, please subscribe: