Image by Arek Socha

Happy Friday and thank you for reading The Matt Viera Newsletter!

Quick note: I will be off next Friday for the Thanksgiving holiday weekend.

You can look forward to The Matt Viera Newsletter in your inbox on December 2, 2022.

Before I get into the main topic, let me introduce you to my friend Jose.

Jose and I worked together a few years ago. Jose is a brilliant and interesting individual. We don’t speak too often, but when we do, I soak up everything he says because most of it is thought-provoking.

For example, Jose is from Spain and loves sharing how Spaniards “have the art of living down to a science.”

I have no counter to that statement. Having been to Spain multiple times, I can attest to its veracity.

When I recently traveled to Spain, I contacted Jose to let him know. About a day into my Spanish vacation, I had a severe cold. Jose texted me to ask how the trip was going, and I informed him I was really sick. His reply:

I guess that first day you had a purge of all that toxic stress built up inside. Because of the way we were programmed to live our life in the US, it is a shock to the system to realize that life is actually pleasant surrounded by beauty and stress free.

The word “programmed” resonated with me.

I’d argue that in the U.S., we are programmed that working a 9-5 job for decades is as natural as the high and low tides of the sea. We spend our most precious resource—time—working in an endless pursuit to obtain more and more products.

We live in a culture of consumerism, using credit cards and spending money, as my friend Max would say, “to obtain things we don’t need trying to impress people who don’t care.”

The more we want, the more debt we accrue, and the higher a salary we chase, to buy more of what we want.

And the cycle continues until we are in our 60s and can, maybe, retire. And then what? We have what, perhaps, 15 years to enjoy the rest of our lives on our terms?

I admit that was precisely my goal.

I am trying to de-program myself.

I wish I had this realization decades ago.

If my net worth was $1 million+ the day I was told I had to return to work in the office every day, I would have quit my job.

Now I am trying to catch up. I want to live the rest of my life on my terms, not society’s or my employer’s terms. How?

By managing my personal finances effectively.

Unfortunately, most people don't know how to manage their finances effectively.

This ineffectiveness with personal finances affects mental health.

Here are some data:

• 77% of Americans report feeling anxious about their financial situation

• 52% have difficulty controlling their money-related worries

• 68% worry about not having enough money to retire

• 56% worry about keeping up with the cost of living

• 58% feel that finances control their lives

• 45% worry about managing debt levels

If you can learn to manage your personal finances effectively, you can begin to realize your financial goals and start building wealth.

Maybe the path to freedom [is] spending less and living more simply.

Here are 6 simple steps to start managing your personal finances to build wealth:

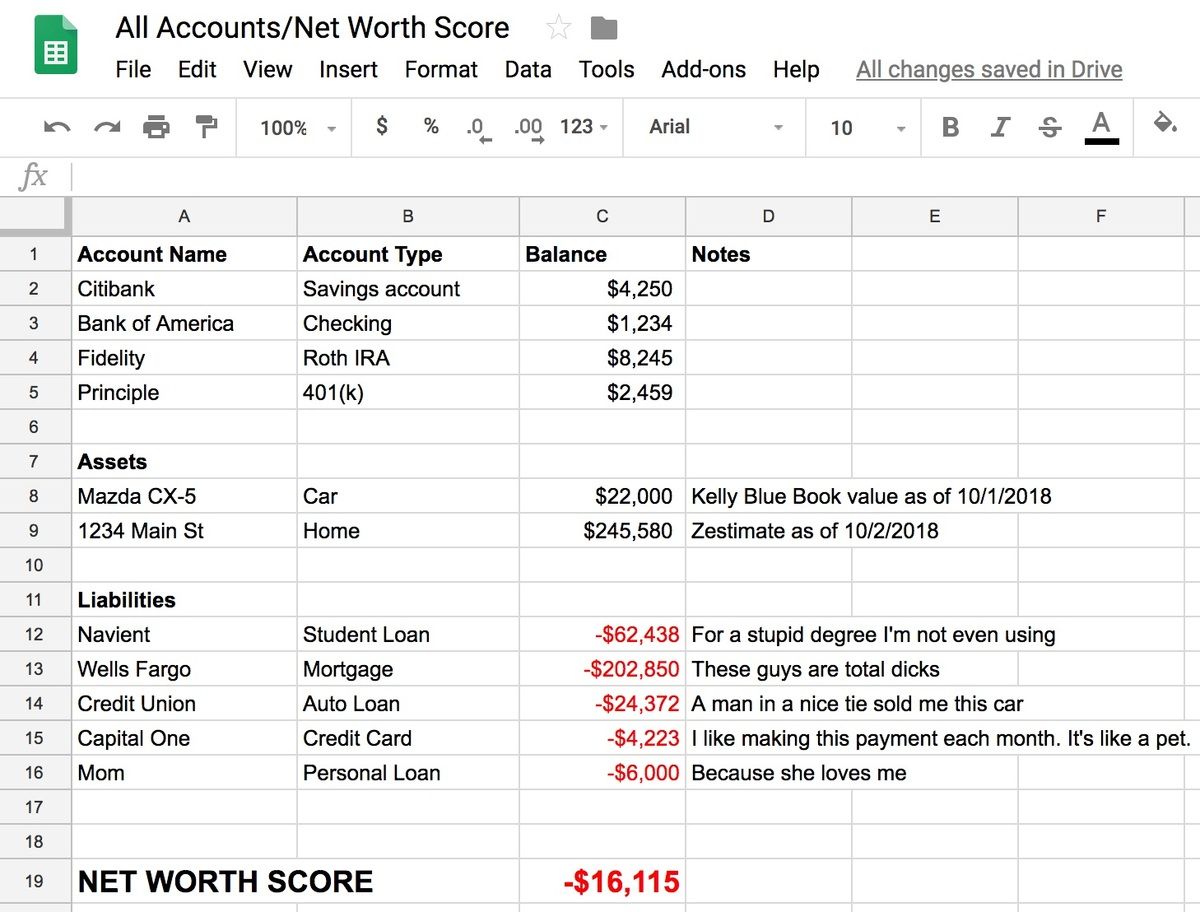

1) Determine your net worth.

You can determine your net worth (what you own and owe) by knowing the value of your assets (house, car, financial accounts) and subtracting your liabilities (loans, credit card debts.

Use the following as an example:

https://www.personalfinanceclub.com/how-to-calculate-your-net-worth/

2) Understand what you spend.

The best way to understand what you are spending your money on is by tracking your spending.

Getting an overall idea of how you spent money for the past 3 or 4 months is a good start. Review your debit card (and, if used, credit card) statements.

Set up a spreadsheet in excel or google sheets using my spending tracker as a template. Set up a spreadsheet for each month.

Set aside some time and start tracking your spending today. Doing this daily is more manageable, especially if you use cash for purchases.

(Days of the week listed horizontally, categories of expenses listed vertically):

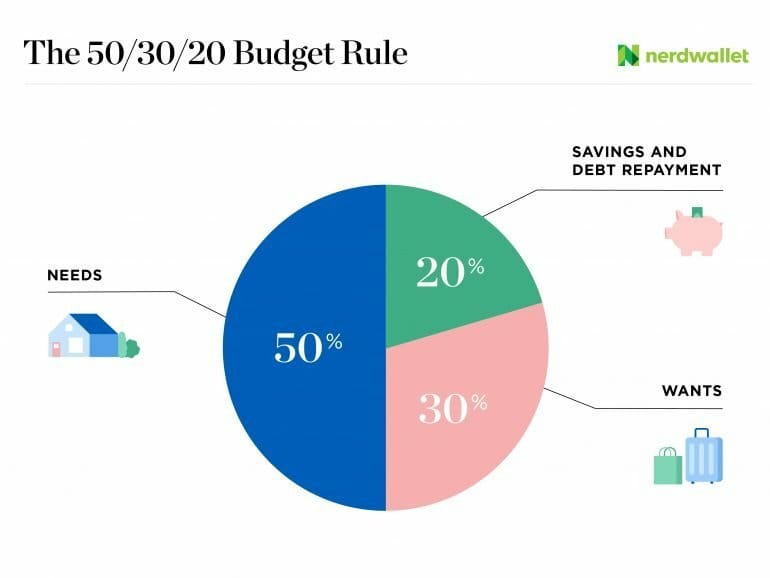

3) Set up a budget.

You can easily set up a budget using the following as a guideline:

4) Identify your short, mid, and long-term goals.

For example:

Short-term goal: pay off credit card debt.

Mid-term goal: build emergency fund.

Long-term goal: pay off mortgage or build investment account.

5) Ask yourself, "What is my next best step?"

Your next best step is to first accomplish your short-term goal. Go for that sure win.

Now you know how you are spending your money and set a budget to curb your spending, you can redirect money towards your goals.

For example, from September 2021 through December 2021, I spent ~$400 - $500 on happy hours, brunch, take-out, etc.

By reducing the amount I spend in that category by $200-$300 per month, I can redirect the money not spent in that category toward credit card debt.

If you have only one credit card, focus on eliminating that debt. If you have multiple credit cards, you should first focus on the credit card with the highest interest rate or the credit card with the smallest balance. Once the debt is eliminated, stop using that credit card.

6) Focus on that action and check your progress periodically.

Set aside time weekly, bi-weekly, or monthly to develop a habit of tracking your spending and assessing progress towards your goals.

You can always make adjustments if necessary.

The key is discipline and consistency.

Everyone's financial situation is different. However, by using and adapting these 6 steps to your financial situation, you can begin to move forward to achieve your financial goals and increase your net worth.

The earlier you can build your net worth, the sooner you can realize and accomplish your financial goals, e.g., investing, planning for retirement, building wealth.

Ultimately, you want to build wealth to live your life on your terms.

Thanks for reading!

Please share this with someone you believe would enjoy reading this.

Check out my other articles here.

Follow me on Twitter.

If you are not a subscriber, please subscribe:

Sources: